NonFarm Payrolls, Confirmation Bias edition

Today’s (belated) nonfarm payroll report had a little something for everyone. Whether you are bullish or bearish, recession or expansion, MAGA or Never Trump, there were nuggets of data in the report for you. My charge is to put this into a broader context minus the bias. Let’s jump into the specifics: The… Read More The post NonFarm Payrolls, Confirmation Bias edition appeared first on The Big Picture.

Today’s (belated) nonfarm payroll report had a little something for everyone. Whether you are bullish or bearish, recession or expansion, MAGA or Never Trump, there were nuggets of data in the report for you.

My charge is to put this into a broader context minus the bias.

Let’s jump into the specifics: The Bureau of Labor Statistics saw upside surprises in Jobs, Wages, and Unemployment Rate, and downside surprises to hiring breadth1 and annual revisions.

– Total nonfarm payroll rose 130,000 in January (double consensus)

– Unemployment rate fell to 4.3% (7.4 million unemployed)

– Average hourly earnings rose by 15 cents (0.4%) to $37.17

These figures are all higher than they were a year ago: the U3 jobless rate was 4.0%; the number of unemployed people was 6.9 million. Wages were also lower – $35.87 in January 2025. The gains were narrow and likely more seasonal than usual; there were also seasonal distortions that favorably adjusted for January layoffs in education (new term) & construction (bad weather).

The biggest surprise was the annual benchmark revision. 2025 was far worse than many (most?) previously thought. Total job creation for the year was slashed to just 181,000. That downward revision of 898,000 jobs (seasonally adjusted) was the second-largest negative adjustment on record, trailing only the 2009 financial crisis.

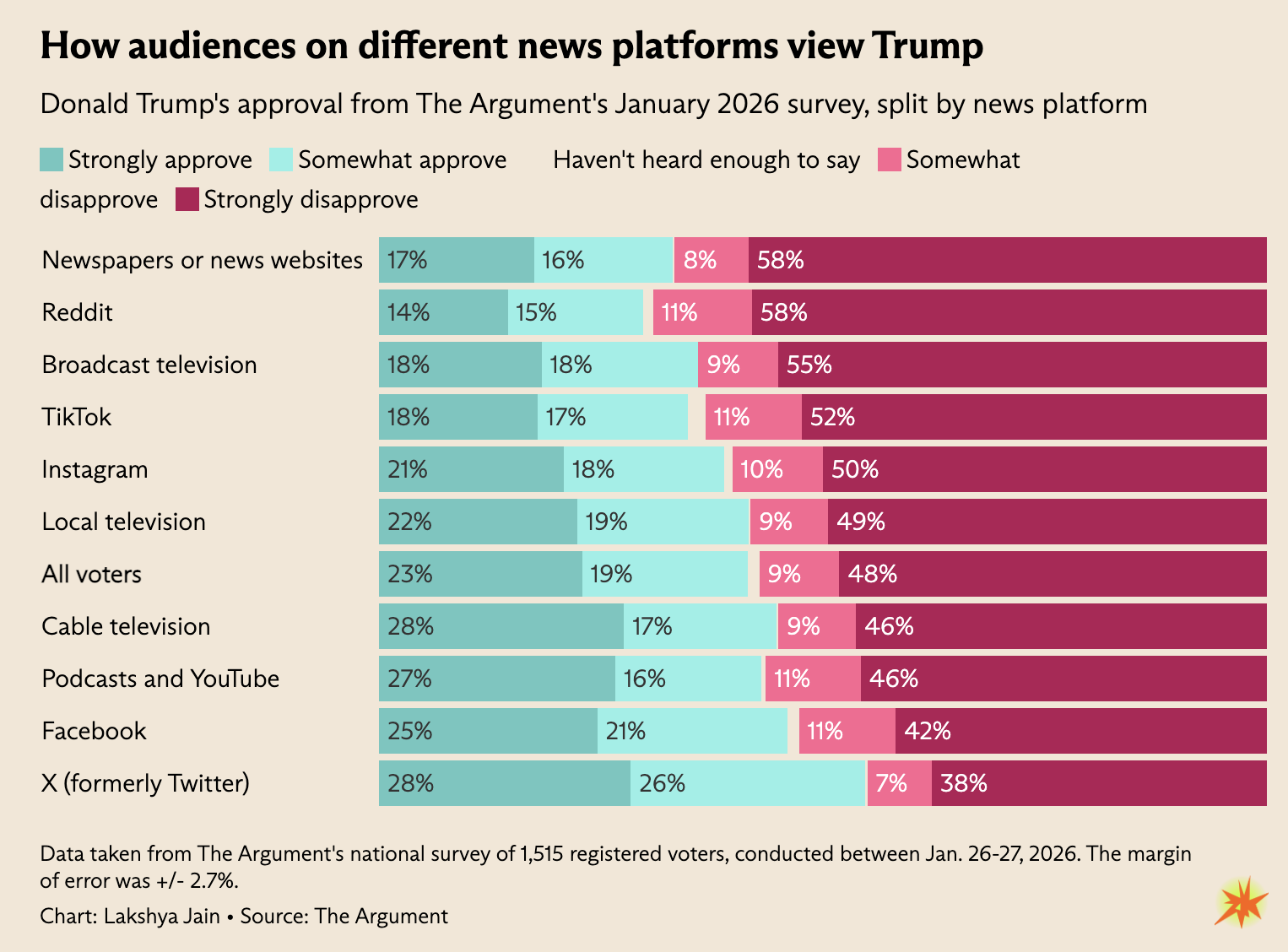

Here is what annual job revisions look like:

Average monthly revisions:

2025: -86k

2024: -94k

2023: -52k

2022: -8k

2021: +161k

2020: -29k

Totally revisions

2025: 1,208k to 181k (-1,027k overall)

2024: 2,589k to 1,459k (-1,130k)

2023: 3,140k to 2,515k (-625k)

2022: 4,619k to 4,526k (-93k)

2021: 5,331k to 7,268k (+1,973k)

2020: -8,893k to -9,246k (-353k)

The benchmark revisions also revealed that the labor market contracted in 2025 in four separate months—January, June, August, and October.

My confirmation bias? It’s all about tariffs. They are the underlying cause of the weakness in the 2025 labor market.

The chart at the top only shows monthly changes in NFP—not the absolute level of employment. When we examine total employment levels, we find 2025 to be an appreciably worse labor market than 2023 or 2024. Have a look at this chart via the Hiring Lab:

This chart shows that the further we get away from the giant 2020-21 fiscal stimulus, the more the economy softened. Not coincidentally, the weakening jobs market coincided with a decline in CPI inflation from its June 2022 peak.

While we have seen substantial revisions in each of the past 5 years, it’s telling that those were from much higher levels. The current data suggest we are in a “low-hire, low-fire” environment; this may be contributing to the decline in consumer sentiment.

But I am not in the recession camp (yet); I’d put the odds of a first-half 2026 contraction at about 25% and in the second-half of 2026 closer to 40%. Not a high probability of recession, but if we see further economic missteps, a recession might be the result. (I know, pretty wishy-washy).

My main takeaway is the labor market is showing cracks and signs of stress; it looks increasingly fragile, even as equity markets hit all-time highs.

~~~

These revisions to 2025 are legitimately alarming. Hiring breadth remains way too narrow. And the data itself is arguably less reliable than it used to be. Interpreting NFP reports has become more challenging than ever…

Previously:

IEEPA Tariffs Update (January 27, 2026)

Where is the Tipping Point? (September 22, 2025)

NFP Disappoint; Revisions Worse (August 1, 2025)

7 Increasing Probabilities of Error (February 24, 2025)

Risks & Opportunities of the New Administration (February 3, 2025)

__________

1. Beneath the headlines, the breadth of hiring was very alarmingly narrow. Of those 130,000 new jobs, health care and social assistance accounted for 95% of the total.

The post NonFarm Payrolls, Confirmation Bias edition appeared first on The Big Picture.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0